Why Invest in Real Assets? Population Growth and Urbanization

Why invest in real assets?

There are many reasons why we believe it makes sense for RIAs to invest in this unique asset class, including the potential for low correlations to mainstream asset classes, strong risk-adjusted returns and inflation mitigation, but perhaps the most obvious is the secular demand that exists around the world.

Every aspect of modern living is connected to real assets. For example, real assets are:

- The buildings we live and work in

- The transportation, energy and digital networks that allow goods, services and information to flow throughout an economy

- The raw materials that fuel society

At Versus Capital , we focus on four primary real asset types: real estate, infrastructure, farmland and timberland. Once these assets are ingrained in society, they become essential to the functioning of a modern economy. We believe global demand for each of these categories should be robust over the next two decades, partially due to the impact of population growth.

Population Growth

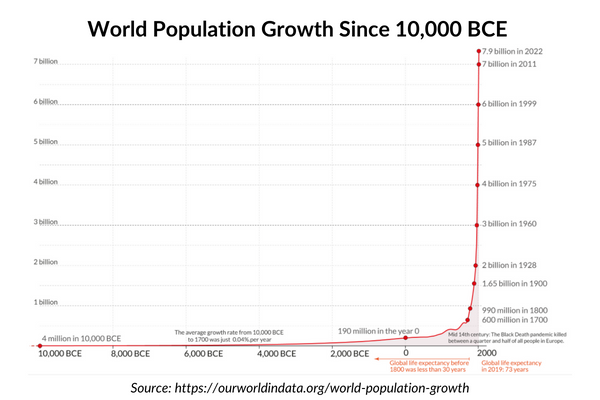

Around the turn of the 19th century, industrial and agricultural expansion coupled with medical innovations like antibiotics and vaccines helped reduce the death rate in humans, resulting in a strong acceleration in population growth. The world population was approximately one billion in 1800. By late 2022, the United Nations estimates that we surpassed eight billion.

The rate of global population growth peaked in 1962 and today’s growth rate is relatively slower by comparison. Nonetheless, the United Nations predicts that the world’s population will peak at 10.4 billion in 2086.

The increase from approximately eight billion people today to 10.4 billion by 2086 represents the addition of 2.4 billion to the global population in just 63 years.

We believe population growth will create multi-decade secular demand for real assets, since it will be necessary to provide enough housing, infrastructure, food and other materials to support these additional people. While the bulk of population growth is occurring in emerging market countries, we expect secular demand tailwinds to impact developed nations as well. For example, farmland and timberland should see strong demand from export markets and we would expect there to be ancillary demand for infrastructure such as energy, seaports and airports.

Urbanization

Throughout history, urbanization tends to be most visible in developing countries when the transition from an agriculture-dominant economy to more of an industrial-driven economy is taking place. But the same trend also exists today in developed nations, including the U.S. and Western European countries.

Despite a short-term reversal during the COVID-19 pandemic, increasing numbers of people are moving from rural to urban areas1, thus requiring more infrastructure, housing and raw materials to support this demographic shift.

- According to the University of Michigan Center for Sustainable Systems, in 1950, just 64% of the U.S. population lived in urban areas. By 2022, that number increased to 83%, and it is estimated that 89% of the U.S. population will live in urban areas by 2050.

- Urban land area in the U.S. is approximately 106,000 square miles. It is projected to more than double by 2060.2

Urbanization, and the economies of scale that come along with it, can help offset the strain placed upon the earth’s natural resources due to population growth. For example, on average, apartment buildings use far less energy per capita than single family homes. Public transportation can help decrease the number of cars on the road. But a vast expansion of the current supply of real estate and urban infrastructure will be needed to facilitate these societal shifts.

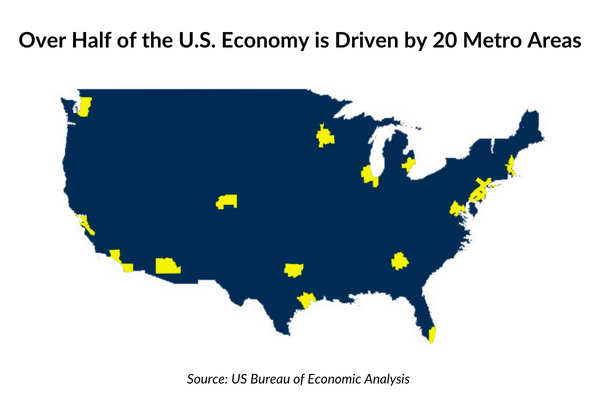

Cities also tend to produce the bulk of a nation’s goods and services.

- In 2018, U.S. metro economies accounted for over 91% of U.S. GDP.3

- Over half of U.S. gross domestic product (GDP) is generated from just 20 metropolitan areas.4

Given cities’ outsized contribution to economic production and the tax revenue this creates, we expect governments to support and incentivize economic growth in these areas, compounding the need for additional housing and infrastructure.

Further, institutional investors have increased their allocations to real assets, with current portfolio allocations estimated at 5% to 10% (with endowments up to 15%5) and we believe this trend will continue, providing another layer of demand for the asset class.

In Conclusion

There are several other important reasons why client portfolios may benefit from investing in real assets, such as low correlations to mainstream asset classes, strong risk-adjusted returns, and potential inflation mitigation. We will be discussing these reasons in upcoming blog posts and a soon-to-be-released white paper. If you are not already subscribed to our insights, we invite you to fill out the form below to be notified when we release new information on real assets investing.

1,2,3 The Center for Sustainable Systems, University of Michigan.

4US Bureau of Economic Analysis

5The Institutional Investor, Nuveen, June 2021

Receive insights on Real Assets Investments

All information contained herein is for informational purposes only and should not be construed as investment advice. It does not constitute an offer, solicitation or recommendation to purchase any security. Any discussion of general market activity, industry or sector trends, or other broad-based economic, market, political or regulatory conditions should not be construed as research or investment advice.

The information contained herein has been obtained from various sources and is believed to be reliable as of the date of publication, but the accuracy or completeness of the information cannot be guaranteed. The opinions expressed are as of the date of publication and are subject to change without notice.

All content posted on our website, including trademarks and logos, constitute Harrison Street Private Wealth intellectual property in which Harrison Street Private Wealth reserves all of its rights. You may not copy, download, publish, distribute or reproduce any of the information contained on this website in any form without the prior written consent of Harrison Street Private Wealth.